After years of waiting, Ethereum finally did what many thought was impossible—it broke free from Bitcoin's shadow and reached new heights. The weekend rally to $4,954 wasn't just another price pump; it was Ethereum's declaration that the crypto landscape is changing, and it's ready to lead the charge.

This breakthrough comes at a crucial time when institutional money is flooding into crypto and smart contracts are becoming the backbone of digital finance. For the first time since 2021, ETH holders can say they're sitting on fresh all-time highs, and the implications go far beyond just price action.

Ethereum Price Rally and Market Impact

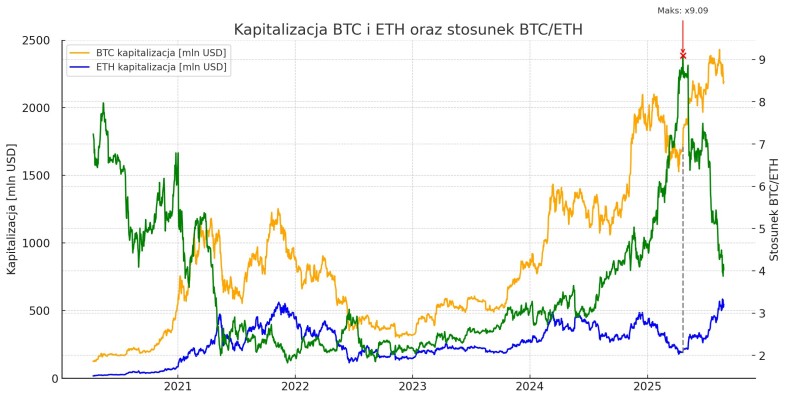

The numbers tell the story perfectly. When trader @BlogiBossaPL highlighted the BTC/ETH ratio collapse from 9.09 to 3.87, it wasn't just market trivia—it was evidence of a seismic shift happening right under our noses. Ethereum is no longer playing second fiddle to Bitcoin; it's carving out its own dominant position in the crypto ecosystem.

Currently hovering around $4,565, ETH is taking a breather after its explosive run. But traders aren't sleeping—everyone's watching to see if this consolidation is just a pit stop before the next leg up toward that psychological $5,000 mark that's been taunting crypto enthusiasts for years.

BTC/ETH Ratio Signals Ethereum's Rising Strength

When the BTC/ETH ratio drops this dramatically, it's telling us something important: investors are choosing Ethereum over Bitcoin, and they're doing it with conviction. This isn't just speculative money chasing the next shiny object—it's a recognition that Ethereum's utility as the foundation of DeFi, NFTs, and Web3 infrastructure is creating real, lasting value.

History shows us that when ETH gains this kind of momentum against Bitcoin, it often coincides with periods of explosive ecosystem growth. The ratio sitting below 4.0 suggests we might be in the early stages of another one of those periods.

Ethereum (ETH) Outlook: Can It Sustain Momentum?

Here's what's driving this rally and why it might have legs:

- The staking mechanism is literally removing ETH from circulation while rewarding long-term holders—basic supply and demand economics at work. Meanwhile, DeFi protocols continue to lock up billions in ETH as collateral, creating organic demand that doesn't depend on speculation.

- Then there's the institutional angle. Major companies and financial institutions are building on Ethereum, not just buying it. When you're the go-to platform for tokenized assets and the backbone of Web3, price appreciation becomes almost inevitable.

Sure, volatility is still crypto's middle name, and macro headwinds could temporarily derail the party. But for anyone who's been watching Ethereum's evolution from a experimental smart contract platform to the foundation of digital finance, this ATH feels less like a lucky break and more like an overdue recognition of what Ethereum has become.

Usman Salis

Usman Salis

Usman Salis

Usman Salis