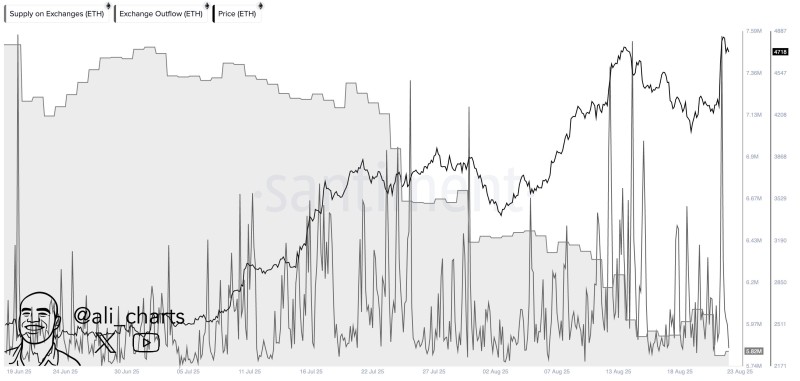

When crypto whales start moving their coins off exchanges in massive volumes, smart money pays attention. That's exactly what's happening with Ethereum right now. In a dramatic 48-hour window, over 200,000 ETH vanished from major exchanges, creating the kind of supply squeeze that often sends prices into orbit.

This isn't just another routine withdrawal. We're talking about hundreds of millions of dollars worth of ETH being pulled into private wallets, suggesting that big players aren't just buying the dip—they're betting on something bigger.

Ethereum (ETH) Price Surges on Massive Exchange Outflows

Ethereum just hit $4,776, and the timing isn't coincidental. When traders see this kind of massive outflow—200,000+ ETH in two days—it tells a clear story: smart money is accumulating hard.

Here's why this matters: coins sitting on exchanges are ready to be sold at any moment. When they disappear into cold storage, that selling pressure evaporates. It's basic supply and demand, but on steroids.

Trader Highlights Bullish Signal

Market analyst @ali_charts didn't mince words about what this means. When you see this scale of withdrawal, it's not day traders moving coins around—it's serious investors positioning for the long haul.

The numbers back this up. Santiment data shows exchange balances have dropped to just 5.82 million ETH, the lowest we've seen in months. Every time we've hit these levels before, ETH has made significant moves upward. History might not repeat, but it sure likes to rhyme.

Why Ethereum (ETH) Price Could Break Above $5,000

Ethereum isn't just riding a technical wave—the fundamentals are rock solid. DeFi is still dominated by Ethereum, NFTs continue to flourish on the network, and institutional staking keeps growing. Add a supply squeeze to that mix, and you've got a recipe for explosive price action.

Sure, technical indicators are flashing "overbought," but when supply is this tight and demand this strong, traditional metrics can go out the window. We've seen this movie before with other major crypto runs.

Peter Smith

Peter Smith

Peter Smith

Peter Smith