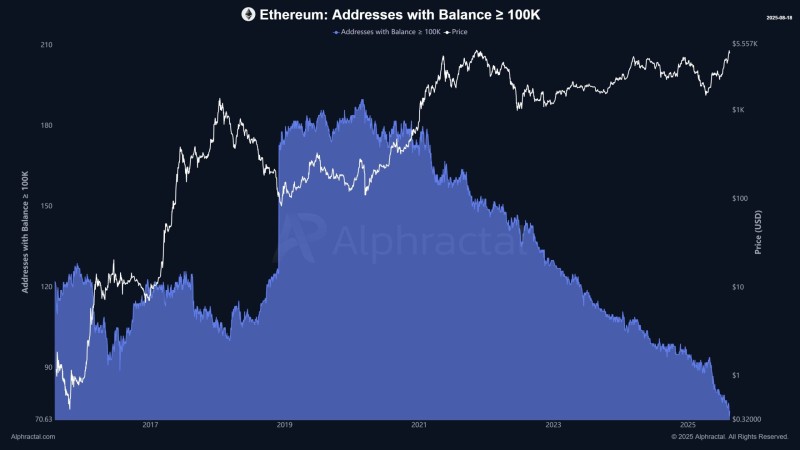

Something weird is happening with Ethereum right now. The biggest holders - those with over 100,000 ETH - are selling like crazy, yet the price keeps climbing. Normally, when whales dump, everyone panics. But this time, analysts are saying "hold up, this might actually be good news."

Here's the wild part: whale addresses have crashed from over 200 in 2020 to just 70 today - the lowest we've seen in nearly a decade. Yet ETH keeps pushing higher. What's going on?

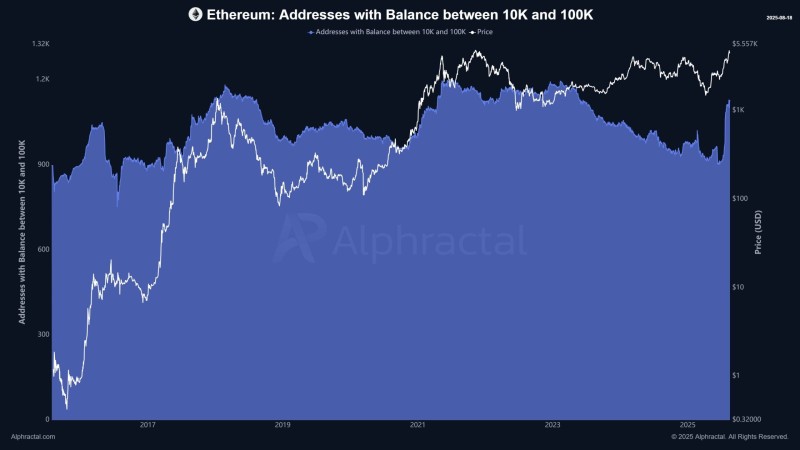

ETH "Sharks" Are on a Feeding Frenzy

While the big fish are swimming away, a hungrier species has moved in. "Shark" wallets - holding between 10,000 and 100,000 ETH - just exploded from 900 to over 1,000 addresses this August alone. These aren't your average retail investors; we're talking serious money here.

Joao Wedson from Alphractal dropped some truth bombs about this trend. He says those massive whale wallets? Most belong to exchanges or early crypto pioneers who might've even lost access to their coins. "The sharks are the real players to watch," Wedson explains. "They're actively buying while the old guard sits idle."

What makes this even juicier is the timing. This shark feeding frenzy kicked off right as publicly listed companies started building their ETH war chests. It's like watching a changing of the guard in real-time.

Institutions Are Hoovering Up Ethereum (ETH) Like There's No Tomorrow

The numbers are absolutely bonkers. Companies and ETH ETFs have gobbled up 10.2 million ETH - that's $39.48 billion worth of Ethereum - and they've been accelerating since July. We're witnessing the greatest wealth transfer in crypto history, and most people don't even realize it's happening.

CryptoQuant data shows something fascinating: while big money wallets keep hitting new records, retail investors are quietly heading for the exits. It's like watching two ships pass in the night - institutions sailing in as regular folks sail out.

Wedson's observation combined with broader market data paints a picture of institutional demand acting like a "black hole," sucking up ETH from everywhere - exchanges, retail wallets, you name it. This isn't just buying; it's systematic absorption of supply.

The endgame? Ethereum might be evolving from a retail playground into a proper institutional asset. Sure, this could mean less volatility and more stability, but it also means ETH is growing up fast. The question now isn't whether institutions will keep buying - it's whether Ethereum can handle becoming the digital equivalent of digital gold while maintaining its innovative edge.

Usman Salis

Usman Salis

Usman Salis

Usman Salis