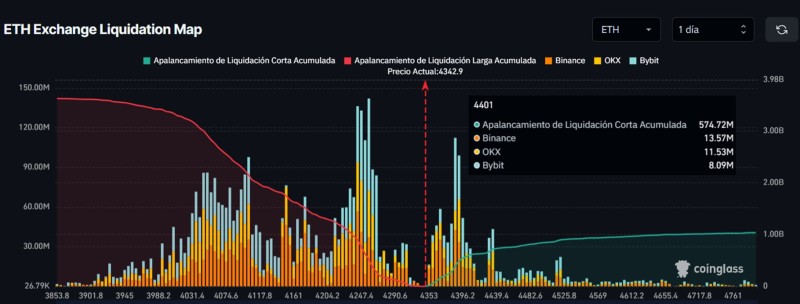

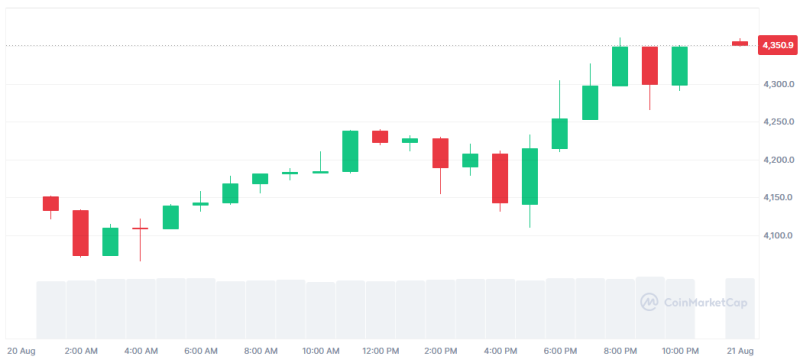

The crypto world is holding its breath as Ethereum trades dangerously close to its most explosive price level in months. A staggering $574.72 million in long positions are lined up like dominoes at the $4,000 barrier. With ETH currently at $4,342, we're just one bad day away from either a spectacular bull defense or a liquidation cascade that reshapes the entire market.

The $4K Danger Zone

Ethereum bulls thought they were safe above $4,300, but they're walking on thin ice. Coinglass data reveals a liquidation minefield stretching from $3,900 to $4,100, with the heaviest concentration right at the critical $4,000 mark.

This isn't just another support level – it's a battleground where over-leveraged traders have painted targets on their backs. If ETH drops just 8% from current levels, we could see the largest single-day liquidation event in recent memory.

Big Exchanges, Big Risk

The liquidation threat isn't scattered across obscure platforms. Binance holds $13.57 million in vulnerable longs, while OKX and Bybit sit on $11.53 million and $8.09 million respectively. When these positions fall, the selling pressure will be a tsunami, not a gentle wave.

What makes this dangerous is the lopsided setup. Traders are overwhelmingly betting on upward movement with no significant short liquidation cushion below. Any break of $4K could turn into free fall territory.

Two Scenarios, One Winner

Bulls defend $4,300 and push ETH back above $4,500: those liquidation walls become rocket fuel, shorts get squeezed, and Ethereum potentially hits new highs.

Or one significant trigger pushes ETH below $4,000: forced selling begets more forced selling, and what starts as a 5% dip becomes a 15% crater in hours.

The next few days will determine whether Ethereum's bull run continues or if we witness one of crypto's most spectacular wipeouts. Either way, boring isn't on the menu.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah