Dogecoin is setting up for what could be its most significant price movement in months, as technical indicators align with overwhelming bullish sentiment across major exchanges. With three-quarters of traders positioning for upside and key resistance levels within striking distance, DOGE appears primed for a decisive breakout that could reshape its near-term trajectory.

Technical Setup Points to Imminent Breakout

Trader @WispOfDeFi has identified a compelling setup in Dogecoin, noting that the TD Sequential indicator has just flashed a buy signal at current levels around $0.2188. This technical development comes as Binance data reveals an impressive 75% long positioning bias among traders, suggesting widespread confidence in DOGE's upward potential.

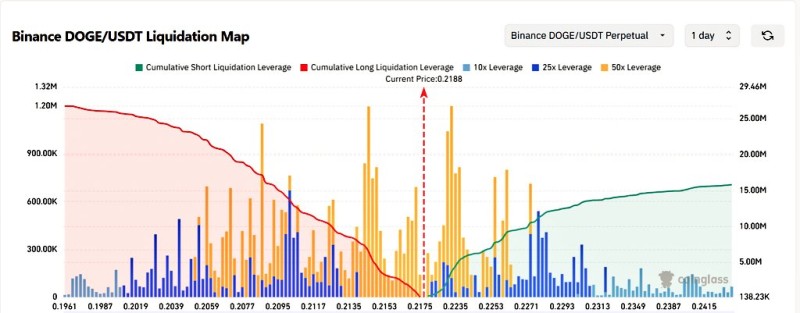

The convergence of these factors creates an intriguing dynamic where technical analysis meets market sentiment. Binance's liquidation heatmap shows substantial liquidity clusters positioned above current price levels, which could act as rocket fuel for any sustained breakout attempt. When combined with the bullish positioning data, this setup suggests that even a modest push higher could trigger significant momentum as short positions get squeezed out.

Critical Price Levels That Could Unlock Major Gains

The path forward for Dogecoin hinges on its ability to clear two key resistance zones at $0.244 and $0.277. These levels have acted as stubborn barriers in recent trading, but the current technical and sentiment backdrop suggests they may finally give way.

If DOGE manages to punch through both resistance levels decisively, the underlying cup-and-handle pattern structure points toward a potential target of $0.42 – representing nearly a 100% gain from current levels. This ambitious target isn't just wishful thinking; it's based on measured moves from the established technical pattern that has been forming over recent months.

However, the flip side of this bullish scenario remains equally important to consider. Should Dogecoin fail to break above the $0.277 resistance zone, the heavy long positioning could become a liability, potentially triggering a cascade of liquidations that sends the price back toward support levels. The key will be whether buying pressure can overwhelm the resistance or if profit-taking emerges at these critical junctures.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah