Dogecoin (DOGE) has been surprisingly stable lately, trading around $0.213 even as other cryptocurrencies experience wild swings. The lack of dramatic price movement has caught traders' attention, especially since DOGE is usually known for its explosive rallies and sharp corrections. What's particularly interesting is the unusual quiet from whale wallets that typically drive the meme coin's biggest moves.

Whale Wallets Show No Clear Direction

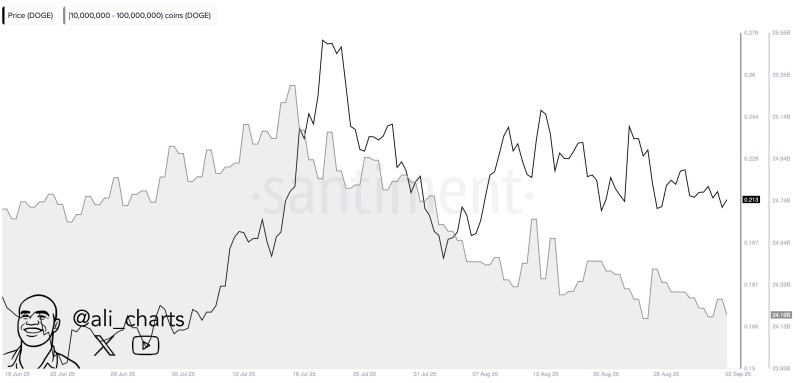

Analyst @ali_charts recently pointed out that Dogecoin's largest holders have been remarkably inactive.

Wallets containing between 10 million and 100 million DOGE tokens maintain a combined balance of approximately 24.19 billion coins, with no significant buying or selling pressure. This sideways action from major players suggests they're waiting for clearer market signals before making their next move.

Technical Picture Remains Neutral

From a price perspective, DOGE is sitting in a relatively comfortable zone. The $0.20 level continues to provide psychological support, while $0.25 acts as the immediate resistance barrier. Without whale participation, breaking either of these levels becomes much more challenging. The current consolidation pattern could persist until larger holders decide to act.

Market Implications of Dormant Whales

Historically, Dogecoin's most memorable price surges have coincided with periods of heavy whale accumulation. When these major players start buying, retail investors typically follow, creating the parabolic moves that made DOGE famous. The current stalemate suggests the market is waiting for a catalyst that could tip the scales in either direction.

The calm at $0.213 might just be the quiet before a significant move, but for now, Dogecoin remains caught between patient whales and uncertain retail sentiment.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah