Bitcoin is currently trading in a crucial range where maintaining key support levels will likely shape its next significant price movement. Market analysts are closely monitoring three critical price zones that could serve as either launching pads for renewed rallies or warning signs of deeper corrections.

Bitcoin (BTC) Price Faces Crucial Support Test

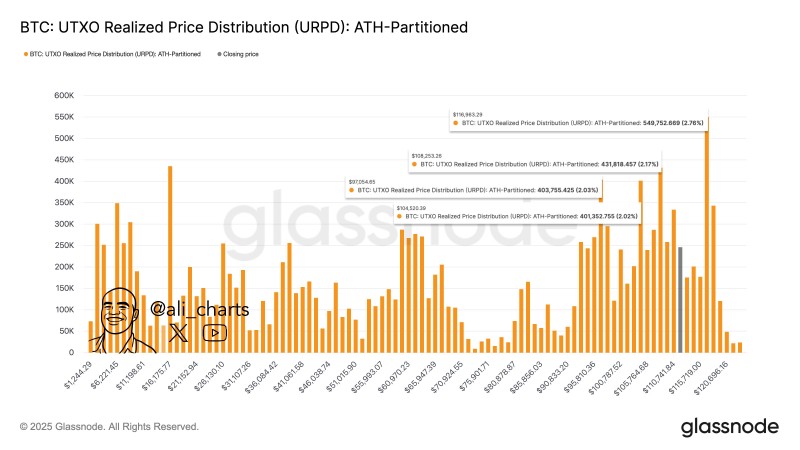

Bitcoin continues trading within a decisive range where holding support will determine its next major move. Glassnode's UTXO Realized Price Distribution (URPD) data identifies the most significant support clusters at $108,250, $104,520, and $97,050 - price points where large BTC volumes were previously accumulated.

Analyst @ali_charts highlighted these thresholds as potential safety nets for bulls. Historically, when Bitcoin consolidates above such support clusters, it often triggers renewed bullish momentum and strong upward moves.

Why $108K, $104K, and $97K Matter for BTC Price Action

The URPD model reveals Bitcoin's cost basis by mapping where unspent transaction outputs (UTXOs) last moved, showing the true price distribution among holders and identifying potential defense zones during sell-offs.

- $108,250 – Immediate support and first line of defense

- $104,520 – Mid-range support with historical importance during past consolidations

- $97,050 – Deeper level that could serve as a final stronghold if selling pressure intensifies

Maintaining these levels makes reclaiming the $115K–$120K resistance range more likely, while breaking below $97K risks a broader correction.

BTC Price Outlook: Bullish Momentum or Correction Ahead?

As long as Bitcoin stays above $108K, traders expect renewed bullish momentum targeting $120K and beyond. However, dropping below $97K could weaken sentiment and invite further downside pressure.

Despite short-term volatility, Bitcoin's long-term fundamentals remain strong, supported by growing institutional inflows and ETF demand that continue backing a bullish macro trend.

With investors watching these pivotal levels closely, the coming weeks will likely determine whether BTC prepares for another rally or enters a corrective phase.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah