Introduction

Europe has positioned itself at the forefront of harnessing crypto solutions through its recent tax reforms and regulatory measures. In five years (2019 - 2024), the number of Italian cryptocurrency holders also rose by 118%. With EU’s pro-crypto environment and increasing crypto ownership, people naturally want to know the best places to trade. User experience, security, government regulations, liquidity, etc, are factors they evaluate before making a decision. Recognising the importance of choosing a trading platform wisely, we researched extensively on the best crypto exchanges in Europe.

Key takeaway: MEXC is the most promising option to trade safely and with wide selection of options.

In this article, we’ll thoroughly examine the features and functionalities of each platform. We’ll also uncover their upsides and downsides so users can find the right match for their goals.

Top 7 Cryptocurrency Exchanges in Europe

1. MEXC

MEXC is a top-performing global centralised exchange (CEX) with a massively growing presence. It saw the largest increase in market share in Q1, growing by 1.7% among all major CEX which is proof of trust. With a focus on accessibility and security, MEXC serves over 36 million users across over 170 countries. It has a sleek and modern user interface, giving first-time Italian buyers a head start. Built with users in mind, it secures assets transparently and offers protection against margin deficit through an insurance fund account. MEXC is also committed to hassle-free privacy and security measures, including security audits, proof of reserves, two-factor authentication, and cold wallets. Users can capitalise on its comprehensive help center which makes it one of the best cryptocurrency exchanges in EU.

Pros

- All-inclusive copy trading features and modes to customise strategy.

- 8000 USDT sign-up bonus to welcome new users.

- Fiat on-ramps feature through its Euro support for OTC trading services.

- Incredibly low and competitive trading fees for users to maximise profit.

- High-leverage options for futures and margin trading allow users to amplify their gains.

- Wide range of trending tokens and airdrop opportunities increase users’ investment options.

- Exclusive crypto challenge bonuses for futures events encourage users’ engagement and boost their trade profits.

Cons

- Limited learning resources when compared to other exchanges.

- No advanced trading algorithms and analytical tools.

- Limited fiat options for Italian users.

- Unregulated in Italy and some other countries.

Trading Fees: Maker fee is 0.0%, and taker fees are 0.050% for spot trading. Meanwhile, maker fees are 0.0%, and taker fees are 0.020% for futures trading.

Payment Options: SEPA bank transfers (local and global), debit/credit cards, fiat deposit via bank transfer (SEPA), MEXC MasterCard.

Supported Cryptocurrencies: Over 2000 coins.

Year Launched: 2018

2. UpHold

UpHold is a cross-asset exchange that allows users to trade multiple types of assets across different investment categories. It supports a global customer base, serving over 10 million users in over 180 countries. Offering a diverse range of asset classes, it facilitates over $40 billion in transactions. The platform's interface is thoughtfully designed and carefully tailored to onboard first-time buyers effortlessly. Users can benefit from UpHold’s rock-solid security system which employs biometric authentication. Another standout feature of the platform is the broad array of wallet options, particularly hot wallets, and the UpHold Vault. This commitment to industry standards in protecting users' funds makes it one of the best crypto exchanges in Europe.

Pros

- Multiple wallet options, enabling flexibility in transactions.

- User-friendly design provides simple and straightforward processes to beginners.

- Competitive conversion rates available to Italian users.

- Extensive learning resources.

- Support in holding and managing crypto assets.

Cons

- Lacks advanced features for technical analysis, charting tools, margin, derivatives trading, and P2P trading options.

- No copy trading feature.

- No margin trading option to borrow funds and leverage positions.

Trading fees: Fees depend on the asset being traded. Stablecoins could have a 0.2% fee and BTC/ATH might have a 1.4%-1.6% fee.

Payment options: SEPA, FPS, digital platforms, Credit card, and UpHold debit card.

Supported Cryptocurrencies: over 250 digital assets

Year Launched: 2014

3. Gemini

Gemini is a reputable exchange known for its dedication to providing high liquidity for users. Its central appeal lies in its security-first approach with innovative solutions such as hardware security keys via WebAuthn. With its easy-to-navigate user interface, the platform operates in over 60 countries. It was recognised as Forbes Advisor's best crypto exchange of 2024 and the overall best crypto exchange by NerdWallet in 2022. Its ActiveTrader feature delivers an all-in-one solution to improve users' trading experience. Furthermore, its partnership with large market makers ensures that traders can tap into markets with strong liquidity pools. Overall, Gemini creates a barrier-free environment for traders, solidifying its status as one of the best exchanges to use in Europe.

Pros

- Secure storage with the most advanced account protection system.

- Native stablecoin, Gemini Dollar (GUSD) for HODLing USD.

- Licenses that ensure compliance, credibility, and trustworthiness for Italian users.

- Additional enhanced security through approved addresses and FDIC insurance for uninvested cash.

- A recurring buy and a price converter feature for users.

- Low maker fees at 0.00% and taker fees at 0.01% for stablecoin pairs.

Cons

- Lacks a copy-trading feature.

- The account verification process can be slow.

Trading fees: For Active trader users, fees range from 0.20% - 0.00% for makers and 0.40% - 0.03% for takers. Market and limit orders also influence fees.

Payment options: Wire transfers, bank transfers, and Plaid Direct Payment.

Supported Cryptocurrencies: Over 70

Year Launched: 2015

4. Binance

Binance is recognized as the world’s largest cryptocurrency exchange, boasting a user base of over 250 million globally. With its extensive line-up of trading options, the leading crypto exchange is one of the top crypto wallets in Europe. Designed with precision for individuals and institutional investors, it provides advanced tools for spot, margin, and futures trading. Italian traders can access higher liquidity, thanks to its multi-currency integration that supports over 350 cryptocurrencies. Additionally, it provides iron-clad security measures such as real-time monitoring, safe sign-in, multi-signature, threshold signature schemes, etc, for users' funds. Italians can also leverage the exchange’s academy which provides users with learning and earning opportunities. Furthermore, it is built with a user-friendly interface for both mobile and PC, making it accessible to users anywhere, anytime. Binance is a suitable option for users who value security and reliability, making it one of the best exchanges to buy crypto.

Pros

- High trading volume with strong liquidity across trading pairs for seamless transaction execution.

- Competitive 0.1% standard trading fee for makers and takers.

- Earn-as-you-learn opportunities available to Italians.

- A lite mode for overwhelmed first-time buyers.

- Multilingual support, including Italian, for inclusivity and accessibility.

- In-built custodial wallet for user convenience.

- “Simple Earn” with flexible and locked-term options offers diverse earning opportunities.

Cons

- Dependency on third-party tools for copy trading features.

- Restriction of users in some countries from trading futures or derivatives.

- Decreased liquidity on certain trading pairs due to restrictions.

- Overwhelming and advanced features for first-time buyers.

Trading Fees: Discounted maker fees at 0.02% and taker fees at 0.05% for futures trading.

Payment Options: SEPA (Single Euro Payment Area), credit/debit cards, bank transfers, and various cryptocurrencies.

Supported Cryptocurrencies: over 350.

Year Launched: 2017

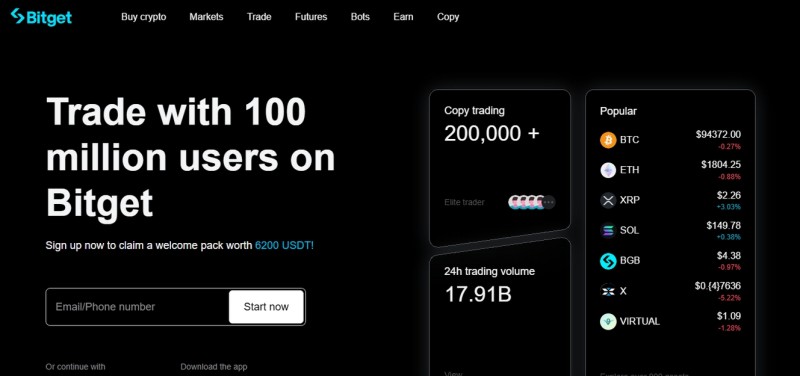

5. Bitget

Bitget is a top-tier multi-functional exchange committed to providing diverse product offerings to users. It serves 100 million users in over 150 countries. Beginners can navigate the platform easily due to its simplistic design. The integration of a Bitget Wallet and Bitget Swap lets users store, manage, and swap cryptocurrencies across varying blockchains. It also has a strong security profile, partnerships with security audit firms, and regular publication of Proof of Reserve Reports. With its established presence, Bitget holds a spot among the top 7 cryptocurrency exchanges in EU.

Pros

- $639 million Protection Fund to enhance security.

- Tiered system for market makers provides high liquidity.

- Derivatives trading, high, and multiple leverage options for users.

Cons

- No social trading option.

- Less advanced analytic tools.

Trading fees: Maker fee is 0.1% (discounted to 0.08% when using BGB for fee payments) and taker fees are 0.01% (discounted to 0.08% when using BGB for fee payments) for spot trading. Meanwhile, maker fees are 0.02%, and taker fees are 0.06% for futures trading.

Payment options: Bank transfers, digital platforms, credit/debit cards, and P2P trading.

Supported Cryptocurrencies: Over 250,000

Year Launched: 2018

6. eToro

eToro is a social trading and cross-asset management platform with 38 million registered users in over 100 countries. Unlike other exchanges, it provides an intuitive and inviting interface with a user news feed for regular market updates. At its core, the platform focuses on user interaction, copy trading, and social trading. It prioritises security, providing data encryption, two-factor authentication, and 3D Secure, which makes it a suitable choice.

Pros

- Smart Portfolio for pre-designed investment strategies.

- Beginner-friendly and innovative interface for a seamless experience.

- Free $100,000 demo account for risk-free learning.

- A CopyTrader feature for ease of use and user involvement.

- Stock lending program to earn extra income.

Cons

- Limited research tools and tradable assets.

- Payment limits in Germany.

- Low leverage options unlike other exchanges.

- $10 monthly fee after 12 months of inactivity.

Trading fees: 1% fee applies to real stocks, ETF, and crypto assets. It charges a 2% transfer fee when crypto is transferred to the eToro Money crypto wallet.

Payment option: eToro money, credit/debit cards, and bank transfers

Supported Cryptocurrencies: 100

Year Launched: 2007

7. Bitpanda

Bitpanda is a European cryptocurrency platform notable for helping users diversify their portfolios into various assets. It utilises advanced encryptions and cold storage to secure the assets of its over 6 million users in 40+ countries. Its broad range of features includes the Bitpanda Spotlight, Bitpanda Fusion, Bitpanda Limit Orders and Bitpanda Card. These features aid liquidity, update users on emerging crypto projects, and enable automated investing. Its compliance with regulatory standards makes it one of the best crypto exchanges in European Union.

Pros

- Free deposits for all fiat currencies.

- Regular Proof of Reserve audits to ensure transparency of customers’ funds.

- Multilingual support and educational resources for Italian users.

- Reliable staking options for earning weekly rewards.

Cons

- Lower trading volume compared to other exchanges.

Trading fees: Fees range from 0.00% to 2.49%

Payment options: Bank transfers, PostePay, Credit/debit cards, Sofort, EPS, Giropay, and SEPA transfers.

Supported Cryptocurrencies: Over 500 crypto assets and 3000 stocks, ETFs, metals and commodities

Year Launched: 2014

FAQs

What is the best crypto exchange to buy Bitcoin in Europe?

Considering crucial factors such as security, liquidity, etc, MEXC stands out as the best crypto exchange to buy Bitcoin in Europe. The platform has a strong security profile and liquidity pools, enabling swift and easy bitcoin trading. It also offers competitive maker and taker fees and complies strictly with local anti-money laundering regulations.

Recognition from Forbes Advisor and NerdWallet as the best exchange to buy crypto positions Gemini as a top choice.

Which crypto exchange offers the lowest trading fees?

MEXC is known for offering an incredibly affordable trading fee, usually among the lowest in the market. Spot and futures trading fees are typically around 0.0% to 0.050%.

Users can also enjoy a 50% discount on spot trading fees when they hold the platform's native token, MX.

Do all these crypto exchanges comply with Italian cryptocurrency regulations?

The compliance of each platform with Italian regulations vary. UpHold is licensed under the Financial Crime Investigation Service (FCIS) in Lithuania, but not specifically in Europe.

Meanwhile, Gemini is registered as a Virtual Currency Operator (VCO) with the Organismo Agenti e Mediatori (OAM). It is also registered as a custodial wallet and exchange services provider with Greece's Hellenic Capital Markets Commission (HCMC).

However, MEXC is not CASP registered in Italy, UK and other countries. It is also not listed in the Special Section of the Italian OAM register.

While Binance is registered as a Digital Asset Service Provider (DASP) with OAM (registration number PSV5), Bitget complies with the EU’s Markets in Crypto-Assets Regulation (MiCAR).

eToro and Bitpanda are duly registered as a provider of financial services and as a Virtual Asset Services Provider (VASP), respectively, with OAM.

Conclusion

With cryptocurrency adoption gaining ground in Europe, choosing the right exchange is non-negotiable. Although some platforms may lack certain features or structures, these exchanges present an array of options to suit different goals. In the long run, selecting the best crypto exchange in the growing Italian cryptocurrency market depends on individual preferences and needs.

Editorial staff

Editorial staff

Editorial staff

Editorial staff