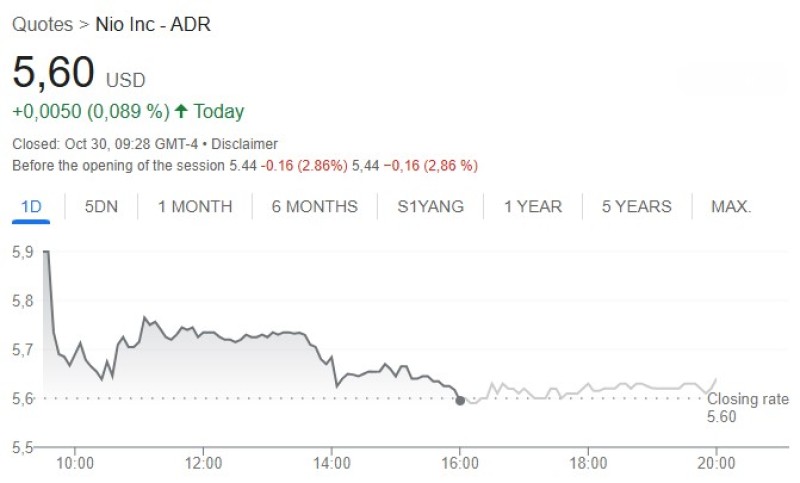

NIO (NYSE: NIO) stock surged by 11% after an analyst upgrade and the debut of its new Onvo L60 SUV, priced at $30,000, aiming to compete with Tesla's Model Y.

NIO Stock Gains Momentum with Analyst Upgrade

NIO stock surged 11% on Monday, fueled by an analyst upgrade and the launch of its new, affordable Onvo L60 SUV. The stock has gained around 33% over the past three months, reflecting investor confidence in NIO’s recent moves to expand its market reach.

Macquarie analyst Eugene Hsiao upgraded NIO to a “buy” rating, setting a target price of $6.60—marking a 25.5% upside from last week’s close. The upgrade is based on projected stronger fourth-quarter sales, bolstered by the launch of the Onvo L60.

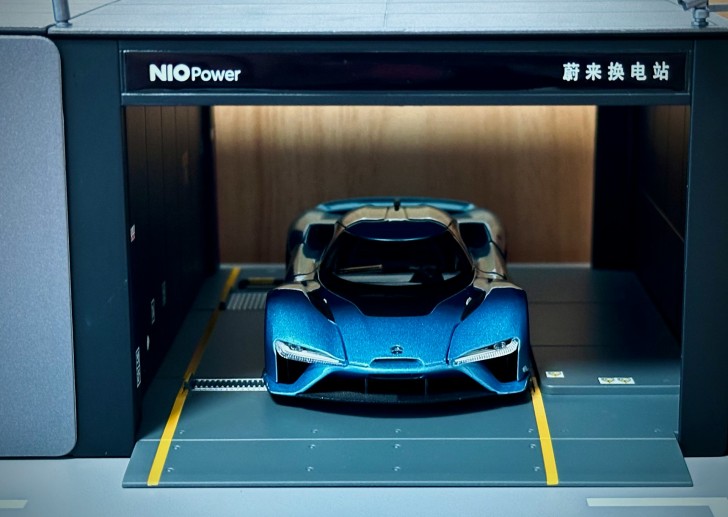

NIO Debuts Onvo L60 SUV to Compete with Tesla

The newly launched Onvo L60 SUV marks NIO’s entry into the mass-market segment, with a price tag of around $30,000, positioning it as a Tesla Model Y competitor. October marks the first full month of shipments for the Onvo brand, which NIO hopes will help solidify its presence in the mid-priced electric vehicle market.

Beyond product launches, NIO has reinforced its financial position with a recent $1.9 billion capital injection led by Hefei Jianheng New Energy for NIO China. This funding is intended to enhance production capacity, particularly for the Onvo L60 model, supporting NIO’s bid to meet anticipated demand.

The market response to the Onvo L60 has been strong, especially in Hong Kong and Singapore, where NIO’s shares rose by 17% following the model’s launch. This momentum reflects positive investor sentiment and supports NIO’s shift towards the mass market, which could redefine its growth strategy.

NIO’s strategic partnership with Abu Dhabi’s CYVN Holdings has opened doors to the MENA region, further diversifying the company’s revenue streams. This expansion may reduce NIO’s dependency on the Chinese market, offering additional growth opportunities.

Investor Focus on NIO’s Upcoming Earnings Report

Investors are closely monitoring NIO’s upcoming third-quarter earnings report, scheduled for early December, with particular attention on fourth-quarter guidance and performance metrics for the Onvo L60. These indicators will shed light on the model’s initial reception and NIO’s execution in the mass-market segment.

The recent performance of NIO’s stock signals a potential turning point for the company, which has faced a year-to-date decline of nearly 38%. However, recent funding and product diversification suggest a strategic shift, potentially enhancing NIO’s competitiveness and broadening its customer base.

With increased trading volume and new ventures into affordable EV segments, NIO’s focus on growth and strategic market positioning appears to be resonating with investors, setting a positive trajectory for the company’s future.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah