NIO (NYSE: NIO) caught traders' attention by smoothly breaking through the crucial $7 resistance level, despite trading on relatively light volume. This breakthrough suggests growing confidence in the Chinese electric vehicle manufacturer as positive momentum continues to build.

NIO Breaks Key $7 Level

Market observer The Real Denny noted that the most impressive part of NIO's recent move was how effortlessly the stock pushed past $7—a price point that had previously served as stubborn resistance. What makes this breakout particularly interesting is that it happened without unusually heavy trading volume, suggesting there's steady demand building underneath.

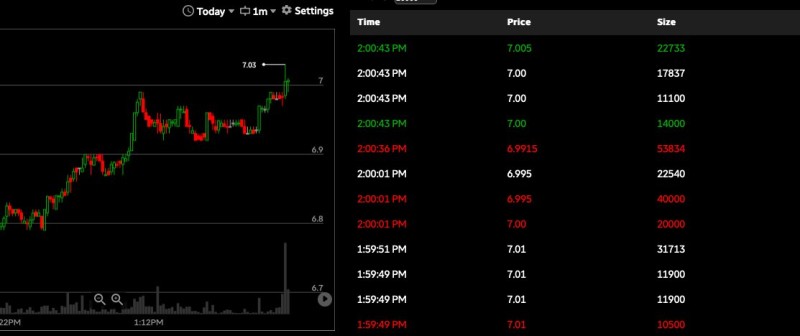

The intraday chart reveals NIO climbing gradually from the $6.80–$6.90 range before pausing just under $7. Buyers eventually drove the price to $7.03, creating a clear breakout pattern.

Technical Analysis Highlights

- Support Level: The $6.90 area has now transformed into short-term support

- Breakout Confirmation: Breaking above $7 confirms bullish momentum with room for additional gains

- Volume Pattern: Though lacking dramatic spikes, steady buying activity hints at larger investors quietly accumulating shares

- Price Target: The successful break opens the door for potential moves toward $7.20–$7.50

This upward move coincides with improving sentiment around Chinese EV stocks, supported by optimistic policy developments and strong domestic market demand. The broader stock market is also getting a boost from speculation about potential central bank monetary easing, creating favorable conditions for risk assets.

Looking Forward

While the breakout creates a foundation for further gains toward the $7.20–$7.50 range, the modest volume during the move leaves open the possibility of a pullback test. The key question now is whether bulls can successfully defend $7 as the new support level. If they manage to do so, NIO could be positioned for continued strength in the coming sessions.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah