NIO Price Performance Reflects Market Optimism Despite Q1 Challenges

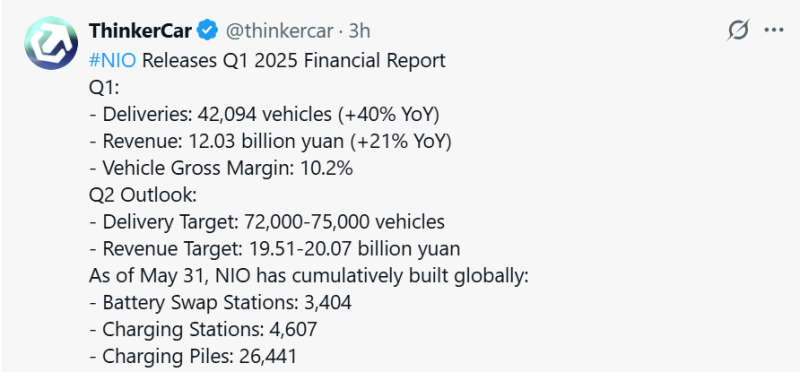

NIO delivered 42,094 vehicles in Q1 2025, representing a 40% year-over-year increase but falling within the company's guidance range of 41,000 to 43,000 vehicles. The delivery figure matches the tweet's reported 40% YoY growth, demonstrating the company's ability to meet its targets in a competitive market.

The company's revenue reached RMB 12.03 billion yuan ($1.66 billion) for the quarter, marking a 21% increase compared to Q1 2024. This revenue figure aligns precisely with the social media post's reported 12.03 billion yuan, confirming the accuracy of the leaked numbers ahead of the official announcement.

NIO Price Stability Supported by Improved Vehicle Margins

NIO's vehicle gross margin improved to 10.2% in Q1 2025, up from 9.2% in the same period last year. This improvement in profitability per vehicle sold has likely contributed to the positive sentiment reflected in today's NIO price movement, despite the company reporting overall losses.

The margin improvement comes as NIO's main brand delivered 27,313 vehicles in the first quarter, while the ONVO brand contributed 14,781 vehicles. The diversification across multiple brands appears to be supporting the company's pricing power and operational efficiency.

Strong Q2 Outlook Could Drive Future NIO Price Gains

Looking ahead, NIO has provided guidance for Q2 2025 deliveries between 72,000 and 75,000 vehicles, with revenue targets of RMB 19.51-20.07 billion yuan. These projections suggest significant sequential growth and align with the figures mentioned in the social media post, indicating potential positive catalysts for the NIO price in the coming quarter.

The company continues to expand its infrastructure network globally. As of May 31, NIO has built 3,404 battery swap stations, 4,607 charging stations, and 26,441 charging piles worldwide. This expanding infrastructure supports the company's long-term growth strategy and competitive positioning in the EV market.

Despite reporting a net loss of RMB 6.75 billion (US$930.2 million) in Q1 2025, representing a 30.2% increase from Q1 2024, investors appear focused on the company's delivery growth and improving operational metrics. The NIO price performance today suggests the market is weighing growth potential against current profitability challenges, with optimism winning out in the near term.

Usman Salis

Usman Salis

Usman Salis

Usman Salis