The AI infrastructure battle is intensifying, and Microsoft just made a power play that's got Wall Street talking. Their new $3.3 billion Wisconsin data center, packed with cutting-edge Nvidia hardware, isn't just another tech facility—it's positioning Microsoft to completely reshape the supercomputing landscape. The stock market seems to agree, with MSFT shares showing strong technical momentum that mirrors the ambition of this groundbreaking project.

Microsoft's Wisconsin Megaproject Takes Shape

Microsoft is putting the finishing touches on its Fairwater data center in Wisconsin, a $3.3 billion facility that's about to become one of America's largest AI-focused computing hubs. The center will house hundreds of thousands of Nvidia GPUs, creating what Microsoft claims will be a system delivering "10X the performance of the world's fastest supercomputer today."

This isn't just about raw computing power—it's Microsoft's bid to dominate the AI cloud services market. By combining their software expertise with Nvidia's premium hardware at this scale, they're creating infrastructure that could redefine what's possible in artificial intelligence applications. Industry analyst Beth Kindig first highlighted this development, noting its potential to transform the entire AI and cloud ecosystem.

MSFT Stock Shows Bullish Momentum

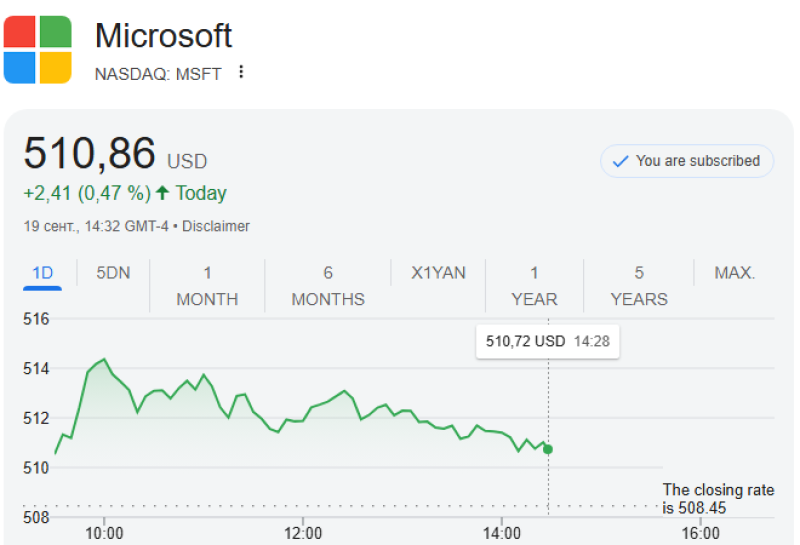

The stock chart tells a compelling story that aligns perfectly with this major announcement. MSFT broke decisively above the $510 resistance level, marking the start of what appears to be a fresh upward trend. The breakout came with significant trading volume, suggesting institutional investors are taking notice and positioning themselves for Microsoft's AI expansion.

Current support has formed around $500-$505, where buyers consistently step in, creating a solid foundation for further gains. If this momentum continues, the next target zone sits at $530-$535, representing meaningful upside potential for shareholders. The technical signals are reinforcing what the fundamentals suggest—Microsoft is making moves that investors believe will pay off.

Nvidia Wins Big from Partnership

While Microsoft grabs headlines, Nvidia stands to benefit enormously as the primary GPU supplier for this massive deployment. Hundreds of thousands of GPUs heading to a single facility reinforces Nvidia's stranglehold on AI computing hardware. NVDA's own chart shows accumulation patterns, with the stock bouncing from consolidation levels and setting up for another potential leg higher.

This partnership showcases how the AI infrastructure boom creates winners across the entire supply chain, with Microsoft securing computing capacity and Nvidia locking in another mega-deal that strengthens their market position.

Investment Implications

Microsoft's $3.3 billion commitment puts them in direct competition with Amazon Web Services and Google Cloud for AI infrastructure supremacy. By combining their established software ecosystem with state-of-the-art hardware at unprecedented scale, Microsoft is building a moat around their cloud AI services that competitors will struggle to match.

For investors, this development signals accelerated growth potential for Azure as AI capacity scales dramatically, while Nvidia continues securing the massive deals that reinforce their GPU market dominance. The strategic partnership between these tech giants is creating a formidable combination that should benefit both companies' shareholders.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah