Self-Invested Personal Pension (SIPP)

A Self-Invested Personal Pension (SIPP) is a defined-contribution pension scheme that allows you to choose where your money is invested. You also have control over how much you contribute and how often.

The earliest you can take funds from your SIPP is usually age 55 (increasing to age 57 in April 2028), unless you need to retire early due to poor health or your chosen provider has different rules.

If you pay into a SIPP, the government adds a top-up payment called tax relief each year until you're 75. You will get tax relief on all of your pension contributions, as long as they don't exceed 100% of your annual earnings or £60,000 – whichever is lower.

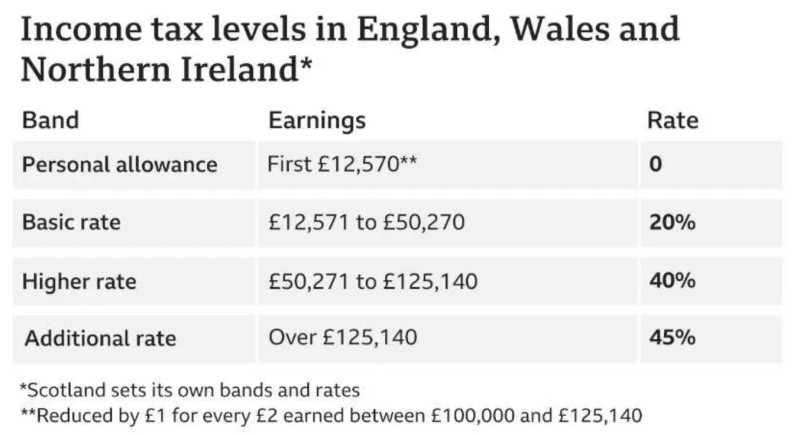

Most pension providers will claim tax relief for you at the rate at which you pay Income Tax: 20% for the basic rate, 40% for the higher rate, and 45% for additional rate taxpayers. For example, if a basic rate taxpayer contributes £100 to their SIPP, it will only cost them £80.

Most SIPP providers will be happy to manage your pension for you and pick investments on your behalf unless you want to choose yourself.

Workplace Pensions

All employers in the UK must offer a workplace pension scheme, which you'll be automatically enrolled into if you're over 22 years old and earning more than £10,000 a year.

The minimum workplace pension contribution in the UK is 8%. The first 5% comes out of your take-home pay, and the additional 3% is made up of your employer's contributions and tax relief. However, the contribution amount can vary depending on your scheme, and in some cases, your employer might match your contributions.

You can choose to opt out of a workplace pension scheme at any time by contacting your employer or the pension provider. However, even if you have a personal pension scheme such as a SIPP, it's a good idea to continue paying into your workplace pension as you will benefit from employer contributions.

Lifetime ISA

UK savers can hold cash, stocks and shares, or a combination of both in a Lifetime ISA account.

Lifetime ISAs have their own annual allowance of £4,000 each tax year, which counts towards your overall annual ISA allowance of £20,000. The government will top up your Lifetime ISA savings with a 25% bonus, up to a maximum of £1,000 per tax year.

When you turn 50, you can no longer pay into your Lifetime ISA or earn the government bonus. However, your account will stay open and you'll continue to earn interest or returns until you can access the funds at 60.

Lifetime ISAs are one of the best ISA options when preparing for retirement because you are unlikely to touch the funds before you turn 60. You'll pay a withdrawal charge of 25% (losing the government bonus) if you want to access your funds before the age of 60, unless you are using it to purchase your first home or if you become terminally ill.

To open a Lifetime ISA, you must be aged 18 to 40 and a UK resident, a crown servant, or the spouse of a crown servant.

Ready For Your Retirement?

The three savings strategies are a great way to prepare for your golden years and make the most of the tax-free benefits available to you.

Many savers also opt to open a Cash ISA or a Stocks and Shares ISA, as they both have great tax-free benefits that can help your money grow quickly. However, unlike a Lifetime ISA, you can access your funds before reaching the normal minimum pension age (NMPA), so you'll need the willpower not to touch your savings if you use one of these ISAs as a retirement pot.

Editorial staff

Editorial staff

Editorial staff

Editorial staff