While everyone's obsessing over Trump headlines and investor drama, something way more important is happening in the bond markets that barely anyone's talking about. CPI swap curves are climbing fast, and it's basically the market's way of saying "the Fed's probably gonna screw this up somehow." According to recent trading data, long-term inflation bets are spiking as traders position for either Fed policy being too tight or too loose.

CPI Swaps Jump Across the Board

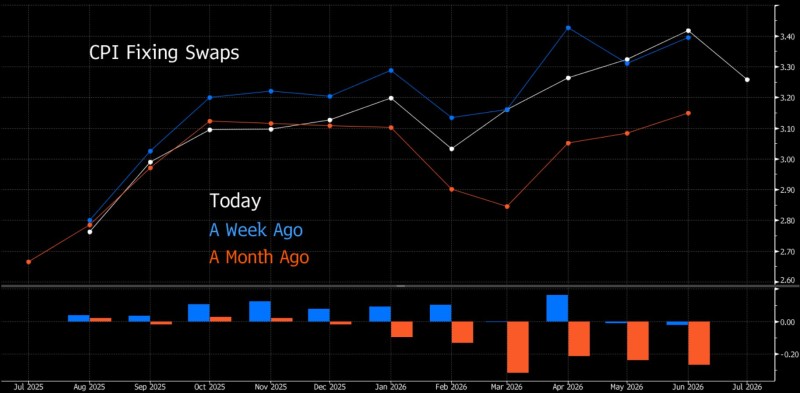

The numbers tell a pretty clear story – traders are getting nervous about inflation staying higher for longer. Here's what's happening:

June 2026 CPI swaps:

- Today: 3.35%

- Last week: 3.42%

- Last month: 3.10%

March 2026:

- Today: 3.28%

- Last week: 3.26%

- Last month: 2.65%

That jump from 2.65% to 3.28% in just a month? That's not small potatoes. It shows traders are seriously rethinking how sticky inflation might be, and they're betting it's gonna stick around way longer than the Fed wants.

Markets Betting Fed Gets It Wrong

Here's the thing everyone's missing while they're glued to political headlines: the bond market is quietly preparing for the Fed to mess up. Whether that means keeping rates too high and crushing the economy, or cutting too fast and letting inflation run wild again, traders are hedging their bets.

The monthly changes are way more dramatic than the weekly ones, which tells you this shift in thinking happened pretty recently. It's like the market suddenly woke up and realized the Fed's walking a tightrope, and there's a good chance they're gonna fall off one side or the other.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah