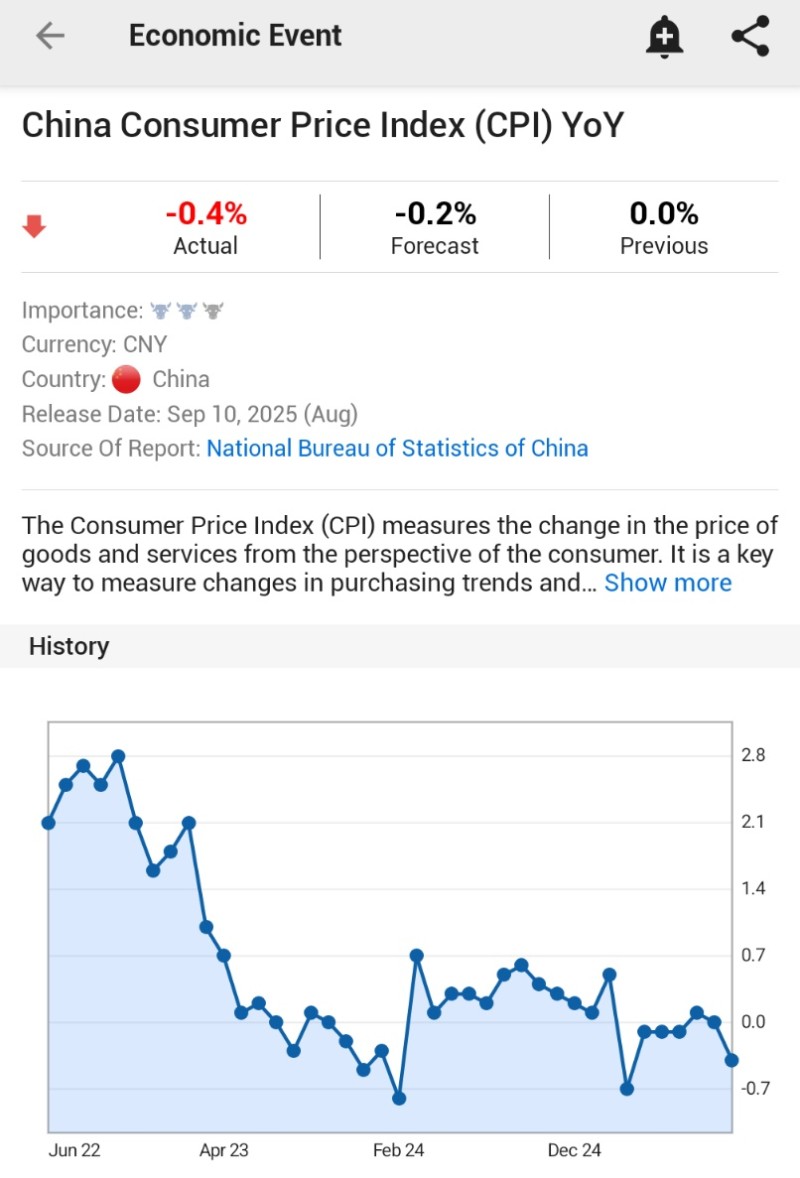

China's economic warning lights just got brighter. August consumer prices dropped to -0.4% year-over-year, worse than the expected -0.2% and a sharp fall from July's flat reading. This is the weakest we've seen since February, and it's painting a worrying picture of an economy that's struggling to find its footing despite repeated government intervention.

Key Warning Signs:

The numbers from Investing.com tell a story that policymakers don't want to hear. Domestic demand is fragile, consumer confidence is shaky, and despite all the stimulus packages thrown at the problem, Chinese households are keeping their wallets closed.

Housing, services, retail - they're all feeling the pinch as people simply aren't spending.

- CPI plunged from 2.8% highs in 2022 to current negative territory

- Multiple failed recovery attempts in 2024 and early 2025

- August's -0.4% reading confirms deflationary pressures are building

- Structural problems including weak consumer demand and property sector stress

The chart data reveals how persistent this downtrend has become. What looked like potential recoveries earlier this year turned out to be false dawns, and now we're back testing the lows again.

What This Means Going Forward

The ripple effects are already spreading. Global commodity markets are feeling the pressure as Chinese demand weakens - oil, copper, agricultural goods are all in the crosshairs. The yuan is facing fresh depreciation pressure, and the People's Bank of China is running out of easy options. They might have no choice but to go deeper with monetary easing or coordinate with fiscal authorities for a bigger response.

Without a real pickup in domestic spending, China's deflation risks aren't going away anytime soon. This isn't just a Chinese problem anymore - it's reshaping global trade patterns and market dynamics as everyone watches to see if Beijing can turn things around.

Usman Salis

Usman Salis

Usman Salis

Usman Salis