XRP rallied to $3.56 after breaking out from $2.17, but now faces a critical resistance zone. Massive whale transfers worth $738 million have traders wondering if the momentum can last.

Whale Moves 210 Million XRP Tokens Worth $738M

Someone just moved a massive 210.6 million XRP tokens between unknown wallets, and crypto Twitter is buzzing. The $738 million transfer has everyone asking the same question: are whales loading up or getting ready to dump?

The timing is pretty interesting. This huge move happened right as XRP is testing the $3.66 resistance level. Smart money doesn't usually make moves this big without a plan, but since the wallets are anonymous, we're all just guessing at their intentions.

These whale transfers often signal big moves coming. The question is whether it's bullish accumulation or bears setting up for distribution. Either way, when this much XRP changes hands, the market usually reacts.

XRP Price Action Shows Mixed Signals

XRP's recent run has been impressive - a clean 60% jump from $2.17 to $3.56. But now it's sitting right below that crucial $3.66 resistance, and the charts are telling a mixed story.

The Stochastic RSI is screaming overbought at 88, which usually means the rally is running out of steam. But the moving averages are still pointing up, so the overall trend looks healthy. It's one of those moments where technical indicators are giving conflicting signals.

Here's the thing - XRP needs to convincingly break through $3.66 to keep this party going. If it can't, we might see some profit-taking and a pullback. The next few daily closes will tell us everything we need to know about whether bulls are still in control.

XRP Derivatives Market Goes Crazy

The derivatives action is wild right now. Trading volume shot up 45.49% to $19.41B, and Open Interest climbed 4.44% to $11.15B. But get this - Options Volume exploded 137.69%, and Options Open Interest jumped 28.04%.

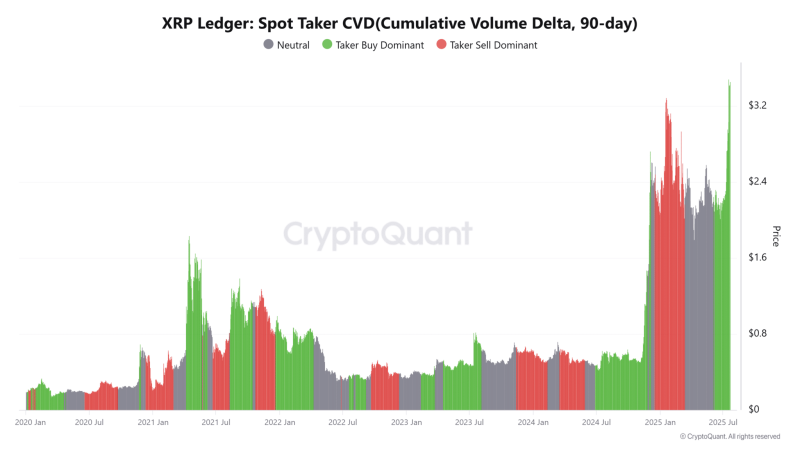

That's a lot of people betting on where XRP goes next. The 90-day Spot Taker CVD shows buyers are still more aggressive than sellers, which is bullish. But when this much leverage enters the market, things can get messy fast if the price moves the wrong way.

More speculation usually pushes prices higher in the short term, but it also means bigger swings when positions get liquidated. XRP traders should buckle up.

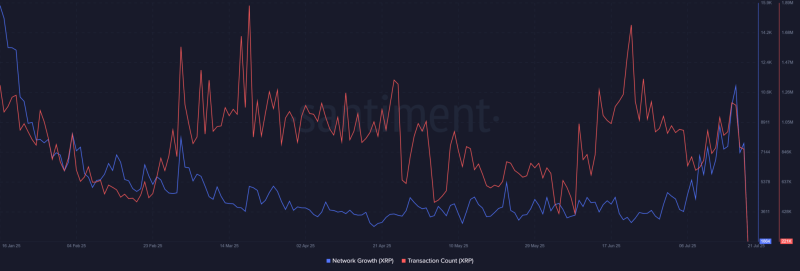

Network Activity Tells Different Story

Here's where things get concerning. While XRP's price is mooning, the actual network usage is tanking. Transaction count dropped to 221K, and only 1,864 new addresses joined the network recently.

That's not great. Usually, sustainable rallies come with growing network activity and new users. When price goes up but usage goes down, it raises red flags about whether the pump is just speculation or has real backing.

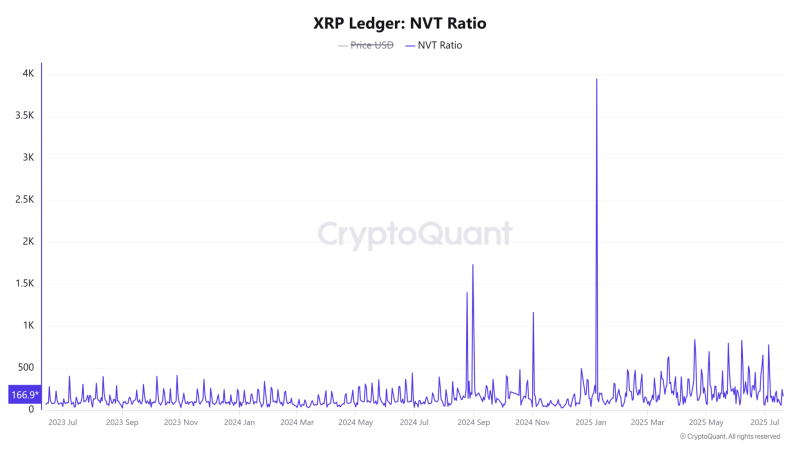

The NVT ratio fell 31.53% to 166.98 in 24 hours. A falling NVT can mean the token is undervalued, but it might also just be short-term trading noise. Without more people actually using XRP, this rally could run out of gas pretty quickly.

XRP is at a crossroads right now. The technicals and whale activity look bullish, but the fundamentals are shaky. Whether it breaks above $3.66 or faces rejection depends on whether the buying pressure can overcome the resistance and if the broader crypto market stays supportive.

Usman Salis

Usman Salis

Usman Salis

Usman Salis