The cryptocurrency market is witnessing a significant shift as institutional investors increasingly turn their attention to Solana. What was once considered primarily a retail-driven asset is now attracting serious money from corporate treasuries and investment firms, with accumulation reaching historic levels that could reshape SOL's trajectory.

Institutional Buying Spree in Solana (SOL)

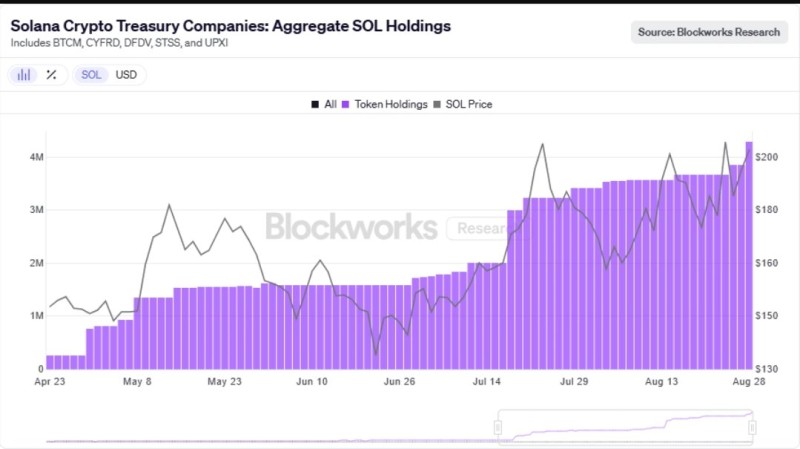

The numbers tell a compelling story. Corporate treasuries have amassed 4.3 million SOL tokens, valued at roughly $905 million. This isn't just gradual accumulation—it's a coordinated institutional push that crypto analyst @MarkETHreal describes as unprecedented in strength.

July's trading data reveals the scale of this institutional interest. SOL-focused firms generated $4 billion in trading volume, completely dwarfing other major cryptocurrencies. XRP, by comparison, managed only $460 million in institutional flows during the same timeframe. This massive disparity shows how quickly Solana has become the preferred choice for institutional portfolios.

Sharps Technologies Bets $400M on Solana

Perhaps the most eye-catching move came from Sharps Technologies, which secured $400 million specifically to buy more SOL. This isn't speculative trading—it's a strategic bet on Solana's long-term potential within the broader blockchain landscape.

Such substantial investments suggest that major players view Solana's ecosystem of DeFi protocols, NFT marketplaces, and scalable infrastructure as more than just hype. They're backing it with serious capital that could drive sustained growth.

SOL is currently testing the $200 level while institutional accumulation continues. If this buying pressure persists, the token could maintain its current strength and potentially challenge resistance levels between $220-$250.

The message from the market is clear: institutional FOMO has arrived, and Solana sits squarely in the spotlight.

Peter Smith

Peter Smith

Peter Smith

Peter Smith