Hyperliquid's HYPE token smashes through $50 barrier amid record trading volumes and aggressive buyback program. The DeFi darling surges 8% in 24 hours, up 430% since April.

HYPE Price Rally: The Numbers Don't Lie

HYPE jumped 8% in 24 hours, hitting $50 for the first time ever. That's a 430% gain since April and 15x growth since November's $3 launch price.

The surge is fueled by Hyperliquid's killer performance as a trading platform. They're using an Assistance Fund that automatically buys back HYPE tokens with trading profits - constantly reducing supply while demand grows.

Record Trading Volumes Drive HYPE Price Higher

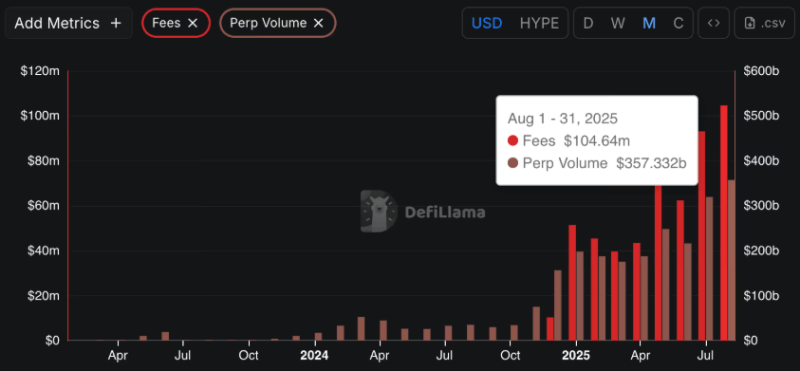

Hyperliquid processed $357 billion in derivatives volume in August alone - up from $319 billion in July and 10x higher than last year. Spot trading also smashed records with over $3 billion weekly volume.

All this activity generated $105 million in trading fees for August - their biggest month yet. The buyback system has hoovered up 29.8 million HYPE tokens (worth $1.5 billion), creating constant buying pressure.

HYPE Price Faces Reality Check Despite Strong Growth

ByteTree analysts called Hyperliquid "among the most compelling protocols in DeFi today," but there's a catch. HYPE trades at a $50+ billion fully diluted valuation with only one-third of tokens circulating.

The real test? Scheduled token unlocks starting November could bring selling pressure. BitGo's recent network support is bullish for institutional adoption, but investors need to watch those unlock dates closely.

Peter Smith

Peter Smith

Peter Smith

Peter Smith